What We Do

Stone Arch Capital is currently focused on growing and exiting our remaining portfolio companies. We are no longer making new platform investments but will continue to evaluate potential add-on acquisitions or other growth opportunities for the existing portfolio.

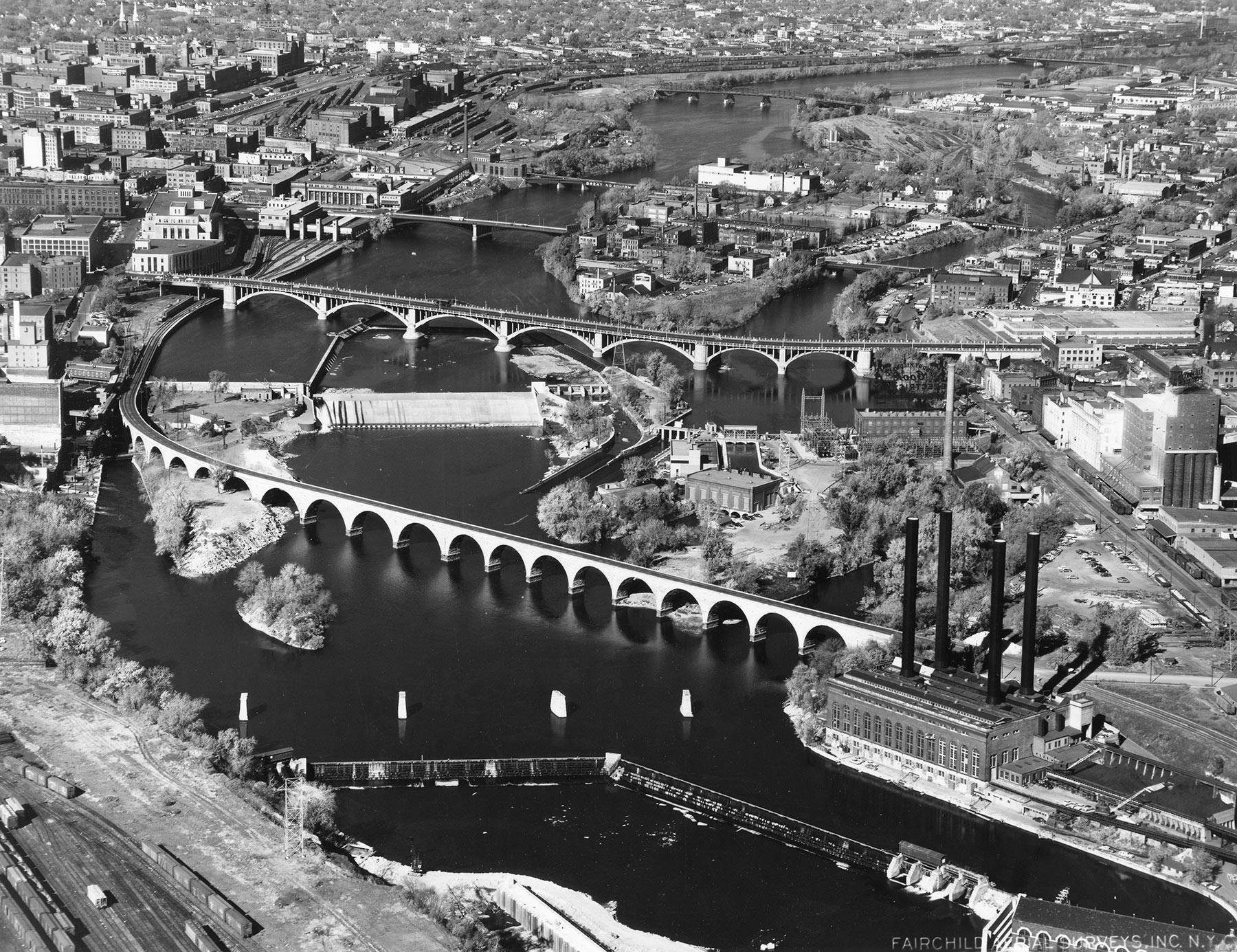

Heritage of our Name

The Stone Arch Bridge, located below St. Anthony Falls in Minneapolis, Minnesota is the only bridge of its kind over the Mississippi River, the Father of Waterways. Built by railroad baron James J. Hill in 1883, the sweeping curvature of the bridge was an architectural breakthrough in its day. For over 100 years, the bridge successfully created a pathway for commerce, connecting the East to the West.

This historical Stone Arch Bridge stands as a symbol of the visionary spirit of Midwestern business and of the Industrial Age that shaped the evolution of our nation. Its characteristics of strength, integrity, and endurance are fitting values for our fund.